Last reviewed - 14 December 2021. Deposit Accounts means all deposit accounts as such term is defined in the Code now or hereafter held in the name of any Credit Party.

Carry-back losses Chapter 7Chargeable income 45.

. Which payments are subject to SOCSO contribution and which are exempted. Chargeable income also known as taxable income is your total annual income minus all the tax exemptions and tax reliefs you are entitled to. Total income 44 A.

Not only has the corporate tax rate been decreased over the years the government has also given SMEs a special rate of 17 on the first RM500000 chargeable income for YA 2019. EPF is a retirement savings account funded by contributions from employers and employees. On subsequent chargeable income 24.

For example lets say your annual taxable income is RM48000. As explained earlier not all salary components are necessarily involved in all statutory contribution calculation. Payments Subject to SOCSO Contribution Wages for contribution purposes refers to all remuneration payable in money by an employer to an employee.

For example if you take up a job while overseas and you only receive the payment for the job when you are back in. A Monthly wages RM5000 and below Minimum of 13 of the employees monthly wages. The declaration turns out to be written instruments or proof of.

In Malaysia income derived from letting of real properties is taxable under paragraph 4 a business income or 4 d Rental income of the Income Tax Act 1967. 34 Statutory income in relation to a person a source and a year of assessment means statutory income ascertained in accordance with the ITA. Malaysia has a wide variety of incentives covering the major industry sectors.

In Malaysia the statutory maternity paid leave period for employees in the private sector is 90 consecutive days. 29 December 2021 Page 1 of 19 1. Employment income includes salary allowances perquisites benefits in kind tax reimbursements and rent-free accommodation provided by the employer.

Jamaica Tax - Statutory Income. This exemption is no longer applicable to tax residents of Malaysia we. Tax Exemption Limit per year Petrol travel toll allowances.

B Monthly wages exceed RM 5000 Minimum 12 of the employees monthly wages. Following the Budget 2020 announcement in October 2019 the reduced rate. Resident company with paid-up capital above RM25 million at the beginning of the basis period 24.

The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. This is because that income is not derived from the exercising of employment in Malaysia. Group relief for companies 44 B.

Non-resident company branch 24. Valuations of some types of employment income are as follows. The corporate tax rate has decreased from 40 in the late 1980s to the current rate of 24.

Here is a list of perquisites and benefits-in-kind that you can exclude from your employment income. The government makes the final decision about minimum wage levels following. Value of living accommodation in Malaysia provided for the employee by or on behalf of the employer rent free or otherwise.

F 1 January 2022. This means that HRmy will calculate the portion based on the percentage decided by you during payroll run. INLAND REVENUE BOARD OF MALAYSIA Date of Publication.

Where incentives are given by way of allowances any unutilised allowances may be carried forward indefinitely to. Therefore income received from employment exercised in Singapore is not liable to tax in Malaysia. Paragraph 131d ITA Amount received by the employee whether before or after his.

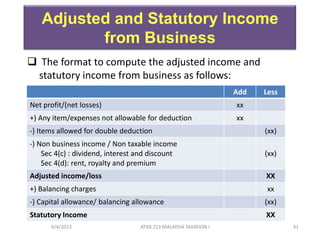

Third Schedule Part A of the EPF Act 1991 Age Group 60 75 years and below. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to. Total income 42 The chargeable income stage and the manner in which income tax is.

Related to Malaysia Statutory Accounts. On first RM500000 chargeable income 17. Malaysia adopted a system of minimum wages in 2013 applying to all workers except domestic workers.

Gross Income is the summation of Basic Salary Earning Bonus - Deduction. Papaya Global payroll platform lets you. Two different rates apply one rate for Peninsular Malaysia and another for Sabah Sarawak and the Federal Territory of Labuan.

Statutory Income is the combined income of any person from all sources remaining after allowing for the appropriate deductions and exemptions given under the Income Tax Act. Statutory Income is also reffered to as Take Home Pay as it is the amount of money you take home after all deductions. A SME is defined as a company resident in Malaysia which has a paid-up capital of ordinary shares of RM25.

Objective The objective of this Public Ruling PR is to explain the computation of provisional. Corporate - Tax credits and incentives. EPF is mandatory for all Malaysian Citizens under employment until the employees attain the age of sixty 60 years and optional voluntary contribution for Malaysian citizen who are.

Salaries tax and social insurance contributions. Energy Accounts means the regional energy accountsstate energy accounts as specified in the Grid Code issued by the appropriate agency for each Month as per their prescribed methodology. Income Exempt from Tax Foreign income of any person other than a resident company carrying on the business of banking insurance or sea or air transport arising from sources outside Malaysia and remitted into Malaysia.

Heres an example of how to calculate your chargeable income. Generally income taxable under the Income Tax Act 1967 ITA 1967 is income derived from Malaysia such as business or employment income. Minimum of 11 of the employees monthly wages.

The statutory declarations is purposed to obtain written confirmation of execution of any deed in the case during company registration the financial statements. Now that you have your total annual income you need to find out what your chargeable income is. People who earn less than 2000 Ringitt per month manual laborers regardless of income level and foreign workers who are legally in Malaysia are covered.

An employee is taxed on employment income earned for work performed in Malaysia regardless of where payment is made. Based on this amount the income tax to pay the government is RM1640 at a rate of 8. Tax incentives can be granted through income exemption or by way of allowances.

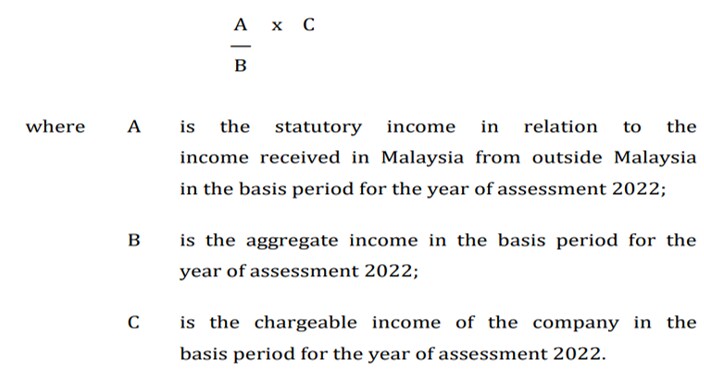

14 Income remitted from outside Malaysia. The purpose of statutory declarations Act 1960 revised 1969 Malaysia has been pointed out in a simplified form below. The example of Malaysia.

A federal statutory body under the purview of the Ministry of Finance. If the amount exceeds RM6000 further deductions can be made in respect of amount spent for official duties. Statutory income Chapter 6Aggregate income and total income 43.

6 Laws of Malaysia A CT 53 Chapter 5Statutory income Section 42. Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax.

Sustainability Free Full Text Multi Stakeholder Platform In Water Resources Management A Critical Analysis Of Stakeholders Participation For Sustainable Water Resources Html

Chapter 6 Business Income Students 1

Statutory Benefits In India What They Are And Why They Matter Oyster

All You Need To Know About The Payment Of Statutory Bonus Legawise

Chapter 6 Business Income Students 1

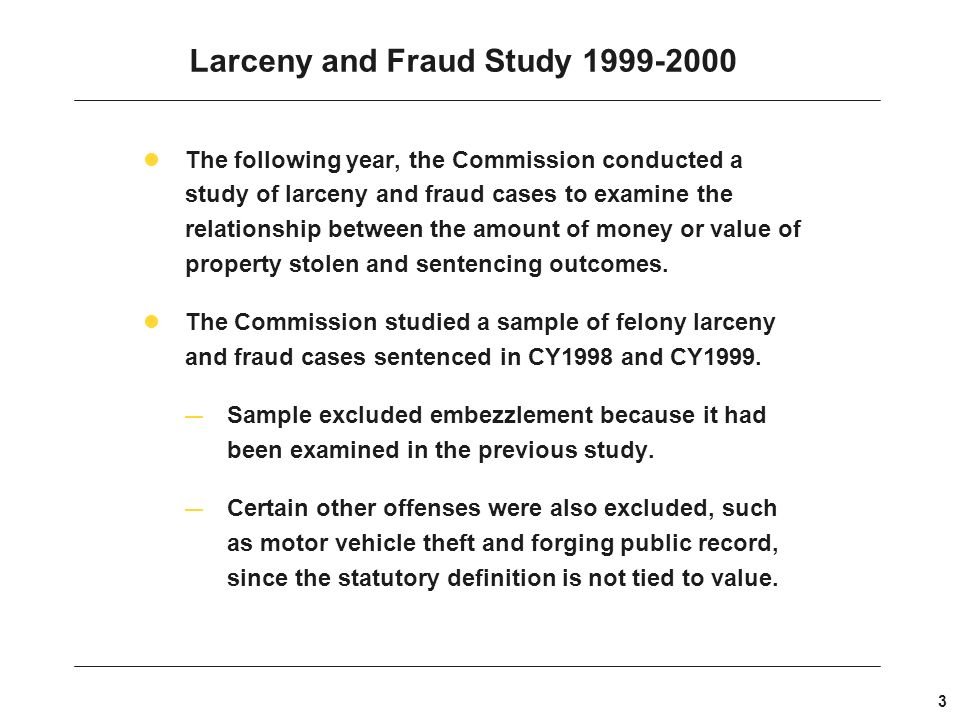

Larceny And Fraud Study Update Embezzlement Study The Commission Conducted A Study Of Felony Embezzlement Cases To Examine The Ppt Download

Partnership Taxation By Zamrin Issuu

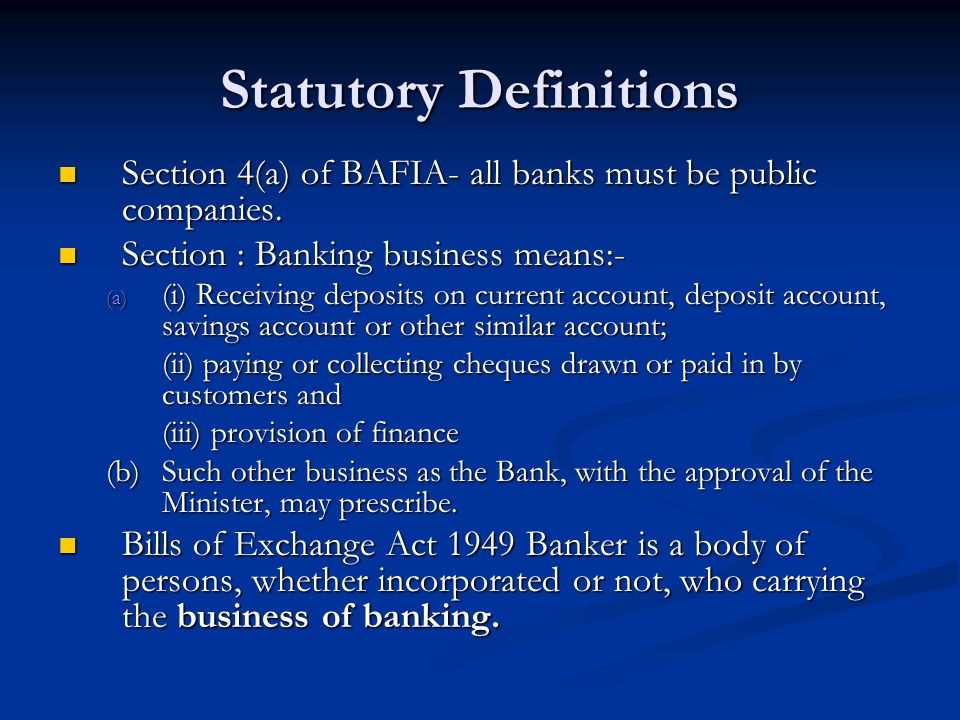

Law Of Banking And Security Ppt Video Online Download

Statutory Reserve Meaning Types What Is Statutory Reserve

Statutory Benefits In India What They Are And Why They Matter Oyster

10 Day Payoff Letter Sample Fresh Arizona 5 Day Notice To Pay Or Vacate Form Notice To Payoff Letter Business Letter Template Lettering

Doing Business In The United States Federal Tax Issues Pwc

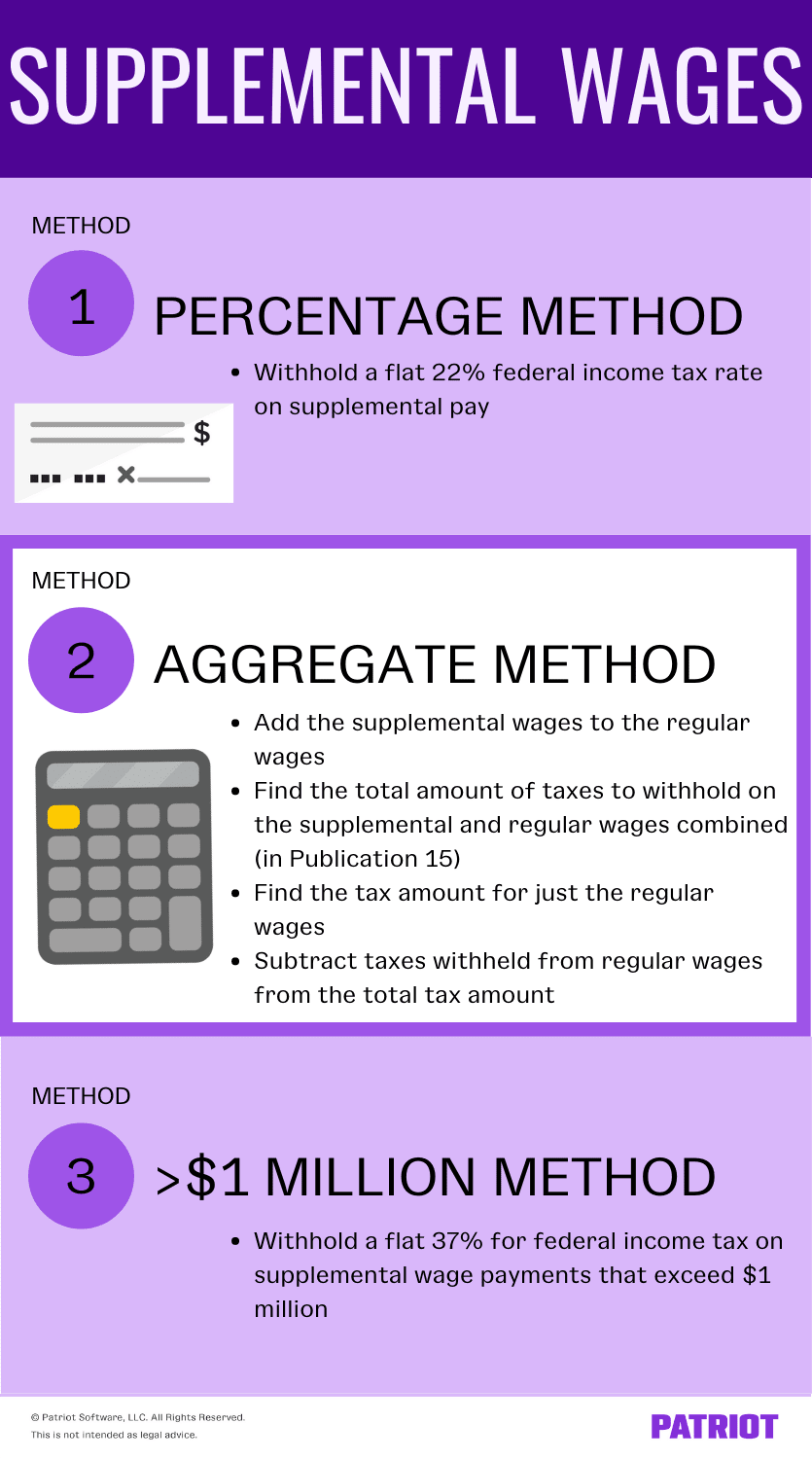

Supplemental Wages Definition And Tax Withholding Rules

/GettyImages-183756341-585286125f9b586e0270091c.jpg)

/dotdash_Final_Reserve_Ratio_Definition_Oct_2020-01-abeb9a9e7e894fddbbbf82dc746152f5.jpg)